If your company is a profitable U.S.-based business engaged in sales of products or services to non-U.S. persons, it may be eligible for a tax incentive that can equate to up to 2 percent or more of the gross export sales. The incentive is known as the domestic international sales corporation (DISC).

Who can qualify

Any profitable U.S. company that sells or leases products for use outside the U.S., where the exported products have no more than 50 percent foreign content by value or performs engineering or architectural services for projects located (or proposed for location) outside the U.S., may be eligible to use a DISC to avoid federal income tax on a portion of its income from the export sales. The incentive works for any type of company, whether a C corporation or a pass-through entity such as an S corporation, limited liability company, or partnership.

How it works

A U.S. company with qualifying export sales, or its shareholders, form a U.S. corporation and elect DISC status for the corporation. Once the DISC is formed, the exporter enters into an agreement with the DISC to pay a commission to the DISC on all export sales. The commission is generally the greater of 4 percent of the qualified export receipts or 50 percent of the taxable income from the qualified export receipts. The commission can be calculated separately for each sale to maximize the commission to the DISC.

As export sales are made, the exporter pays commissions to the DISC and deducts the payment. The DISC pays no tax on the commission income. The DISC generally loans the commissions it receives back to the exporter, or purchases export receivables from the exporter. The DISC’s shareholders pay an interest charge at a very low rate (0.54 percent for 2016) on the DISC’s undistributed income. When the DISC distributes its income to its shareholders as a dividend, it is qualified dividend income eligible for a maximum federal tax rate of 23.8 percent for individuals, considerably less than the maximum rate of 43.4 percent on ordinary income.

Note that even though the DISC may be earning significant income from commissions, loans, and export receivables factoring transactions, it has no employees and no physical assets.

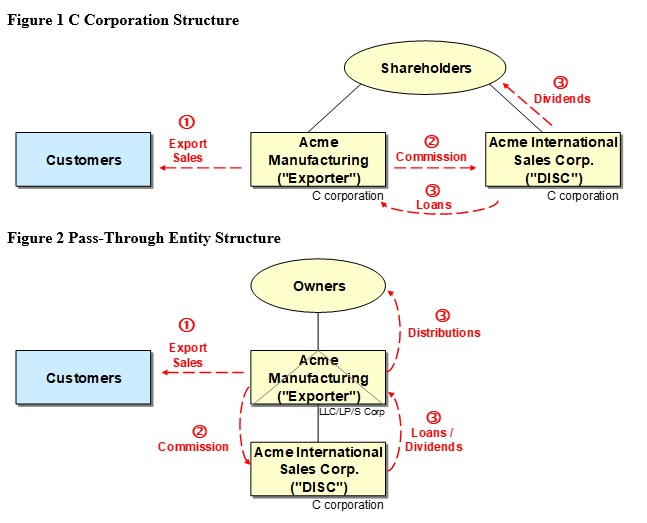

Typical DISC arrangements for a C corporation and for a pass-through entity are illustrated below.

Benefits

If the exporter is a C corporation (Figure 1), using a DISC completely eliminates corporate income tax on the exporter’s income paid as DISC commissions. Assuming a 4 percent commission and a 34 percent corporate tax rate, the benefit is a minimum of 2 percent of gross export sales (on a pre-tax basis), and can be greater if the exporter has high margin (>8 percent) products that can use the 50 percent of taxable income method for computing the DISC commission (applied on a transaction-by-transaction basis).

If the exporter is a pass-through entity (Figure 2), using a DISC converts the exporter’s operating income paid as DISC commissions from ordinary income (43.4 percent maximum tax rate) to qualified dividend income (23.8 percent maximum tax rate), and provides the ability to defer recognizing that income until the DISC distributes it, with only a nominal interest charge for the deferral. Assuming a 4 percent commission and maximum tax rates, the benefit is a minimum of 1.4 percent of gross export sales (on a pre-tax basis), before taking into account the benefits of deferral. Again, the savings can be greater for high margin products.

Types of Eligible Export Transactions

DISC benefits are generally available for receipts from the sale or lease for use or disposition outside the U.S. of products manufactured, produced, grown, or extracted in the U.S. (no more than 50 percent foreign content by value). Benefits therefore extend not only to traditional manufactured goods, but also to agricultural products, lumber and other harvested products, processed chemicals, and other types of products. Eligible transactions also include receipts from services that are related and subsidiary to a qualifying sale or lease.

Eligible transactions also specifically include engineering or architectural services (other than services connected with the exploration for minerals or technical assistance or knowhow) for construction projects located (or proposed for location) outside the U.S., even where the services are performed within the U.S.

While transactions involving the sale or lease of many types of intangible property (patents, trademarks and trade names, franchises, etc.) are ineligible for DISC benefits, transactions involving copyrighted property for commercial or home use outside the U.S. (including films, recordings, software, and similar products) may be eligible for DISC benefits on their licensing fees and any fees for related or subsidiary services. Accordingly, businesses engaged in licensing data or software to non-U.S. users should consider evaluating whether they are entitled to DISC benefits.

Costs

Because a DISC has no employees or physical assets, costs to implement and maintain a DISC are very modest. Companies with as little as $100,000 of annual export sales may benefit from a DISC.

For more information, please contact the Barnes & Thornburg attorney with whom you work or Jim Browne at 214-258-4133 or Jim.Browne@btlaw.com or Bill Ewing at 404-264-4050 or William.Ewing@btlaw.com.

© 2017 Barnes & Thornburg LLP. All Rights Reserved. This page, and all information on it, is proprietary and the property of Barnes & Thornburg LLP. It may not be reproduced, in any form, without the express written consent of Barnes & Thornburg LLP.

This Barnes & Thornburg LLP publication should not be construed as legal advice or legal opinion on any specific facts or circumstances. The contents are intended for general informational purposes only, and you are urged to consult your own lawyer on any specific legal questions you may have concerning your situation.

Visit us online at www.btlaw.com and follow us on Twitter @BTLawNews.